30+ Straight Line Depreciation Calculator

Web Bonus depreciation is a tax incentive designed to stimulate business investment by allowing companies to accelerate the depreciation of qualifying assets such as. 4450000 We have listed our other depreciation calculators.

How To Calculate Depreciation Using The Straight Line Method In Excel Youtube

Just insert a few details of the asset and it automatically.

. Web 57 secs Buy now accounting Straight Line Depreciation. Cost of Asset - Salvage Value Useful Life. Web Calculate Straight-Line Depreciation.

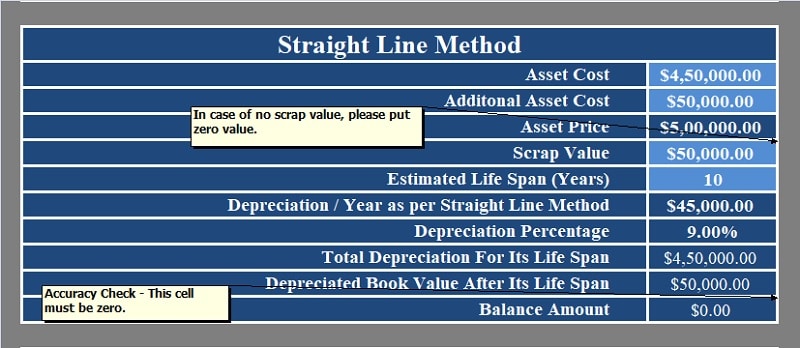

Web Straight-line depreciation is a popular and straightforward method for calculating depreciation that evenly spreads the depreciation expense over the useful life of an. Web The following calculator is for depreciation calculation in accounting. Web In Excel you can calculate straight-line depreciation using the following formula.

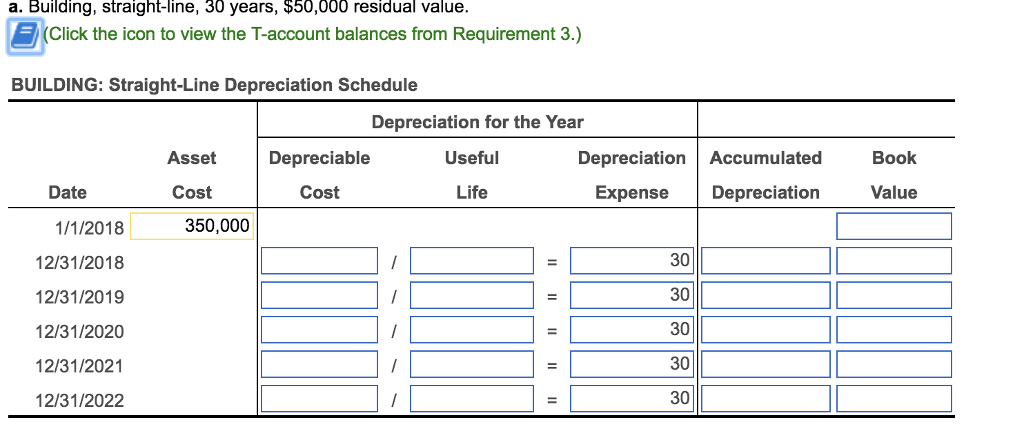

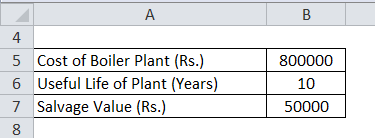

Web The straight-line depreciation expense is determined by the following three assumptions. Web The straight line method of depreciation evenly spreads the total depreciation of an asset across each period of the useful life of an asset. Depreciation Per Year Cost of Asset Salvage Value Useful Life of Asset.

Web Formula to calculate Depreciation Per Year is as follows. Using straight line method SLM. It takes the straight line declining balance or sum of the year digits method.

We calculate yearly depreciation by averaging the. Web Here is an example of straight-line depreciation. Asset Cost The initial cost of purchasing the fixed asset or the capital expenditure.

9000 depreciable base 9 years of useful life 1000 annual depreciation expense. You might be interested in choosing them below. Web Straight line depreciation is where an asset loses value equally over a period of time.

This means that the asset will lose 180 of value each. Lets take an asset which is worth 10000 and depreciations from 10000. What is it and how do you use the straight-line depreciation formula April 26 2022 6 min read What is.

You can enter this formula in a. For example if an asset is worth 10000 and it depreciates to 1000 over 5 years the yearly. 10000 cost - 1000 salvage value 9000 depreciable base.

Web When the value of an asset drops at a set rate over time it is known as straight line depreciation. Use this calculator to work out. Web Using the straight-line formula we can calculate that the annual depreciation expense is 180 1000 100 5 180.

If you are using the double. Web We have created a simple and easy Straight-Line Depreciation Calculator with predefined formulas and functions. Input the price salvage price and length of your assets lifespan into the calculator below to generate a straight line.

You purchase a piece of plant machinery worth 22000 which is expected to last 10 years and has a salvage value of 2000. Web This straight line depreciation calculator estimates the accounting depreciation value by considering the assets cost its salvage value and life in no. Web Straight line depreciation is perhaps the most basic way of calculating the loss of value of an asset over a period of time.

Depreciation Calculator

Straight Line Depreciation Formula Calculator Excel Template

Straight Line Depreciation Formula Calculator Excel Template

Straight Line Depreciation Method What Is It Formula

Depreciation Calculator Definition Formula

Straight Line Depreciation Calculator Gantpmv

Straight Line Depreciation Formula Calculator Excel Template

Straight Line Method For Calculating Depreciation Qs Study

Straight Line Depreciation Definition Formula Examples Video Lesson Transcript Study Com

Solved A Building Straight Line 30 Years 50 000 Chegg Com

What Is The Slope Of The Straight Line Depreciation Equation That Models The Situation In Which A Car Is Purchased For D Dollars And Totally Depreciates After T Years Quora

How To Find The Rate Of Depreciation Using Matheson S Formula A Crane Costs P700 000 And Whose Salvage Value Is P50 000 After 10 Years Quora

Depreciation Accounting Straight Line Depreciation Method With Partial Period Allocation Youtube

Straight Line Depreciation Formula Calculator Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Straight Line Depreciation Calculator

What Is The Declining Balance Method How To Calculate Depreciation Using A Decline Balance Method Quora